Precious Metals Monday 04-11-2019

Gold

Precious metals are starting to break higher as we head into the middle of Q4. The latest action from the Fed has created a supportive backdrop for gold which benefits during times of weakness in the dollar. At the October FOMC held last week the Fed acted in line with market forecasts by announcing a further 25 basis point reduction to its headline rate. The Fed funds rate is now standing at lows of just 1.75%, following the Fed’s third rate cut this year. The October meeting was notably more dovish than the September meeting seeing an increase to 8-2 in favour of a cut, up from 7-3 at the last meeting. However, alongside the higher level of consensus in support of a rate cut, the Fed highlighted that it would now look to hold off from any further adjustments while it monitors the economy and external factors.

Powell said “We believe monetary policy is in a good place to achieve these outcomes,” Powell said. “We see the current stance of policy as likely to remain appropriate as long as incoming information about the economy remains broadly consistent with our outlook.” On the back of the meeting, pricing for a December rate cut is sitting at less than 20%. However, despite the lower pricing, incoming data between now and the December meeting will be closely watched as any further weakness could see this pricing increasing, which would further support the outlook for higher gold prices.

Silver

US rate expectations are not the only element to watch in terms of the outlook for precious metals. The ongoing US-Sino trade negotiations are having important consequences on risk flows, which also drive gold and silver prices. Silver prices remain supported currently on the back of a weaker US Dollar. However, with the US and China looking likely to sign off on the “phase one” trade deal in the coming weeks, equities prices are likely to continue higher, which should exert downward pressure on the metals. Given the opposing forces of upward pressure from a weaker dollar and downward pressure from better risk appetite, flow are likely to remain laboured though in the short term, higher prices remain favoured.

Technical & Trade Views

XAUUSD (Neutral, Bullish above 1534.20)

XAUUSD From a technical and trade perspective. Gold has moved back above the monthly pivot and with longer-term VWAP still supportive, a break higher remains likely. The key level to watch in the short term, however, will be the monthly R1 at 1534.20, if price holds a test of this level we could see a short-term double top taking prices lower. On the other hand, if we break above that level I will monitor a retest for long opportunities.

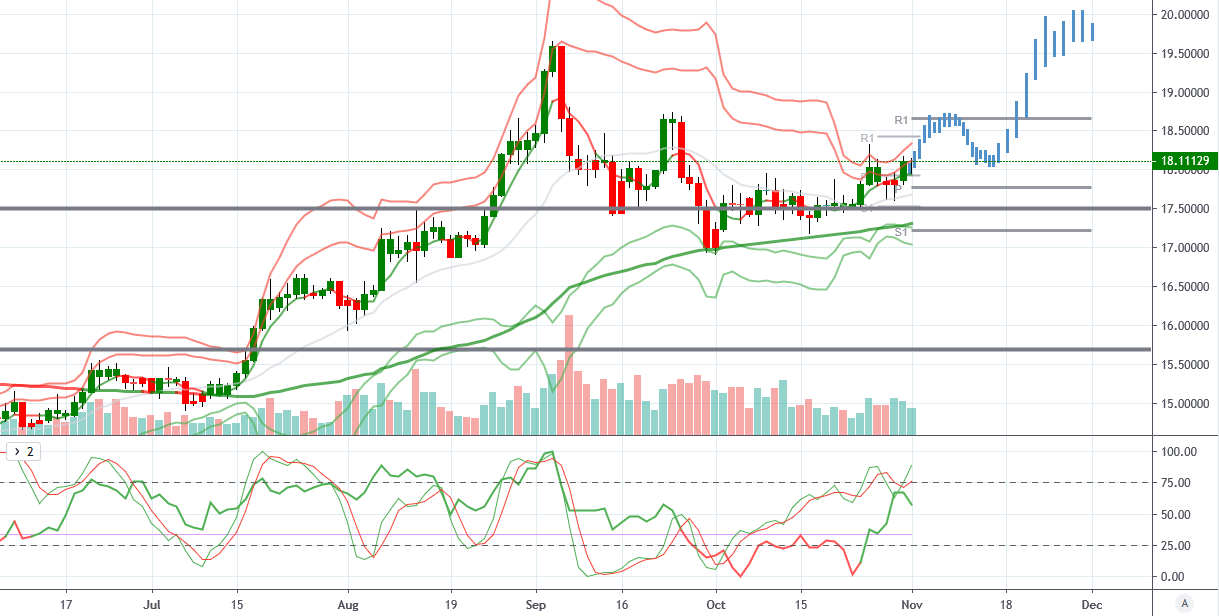

XAGUSD (bullish above 17.50, targeting 19.50)

XAGUSD From a technical and trade perspective. Silver prices remain supported here suggesting a move back into the yearly highs remains likely in the near term. Longer-term VWAP still bullish here also, keeping the bias on higher prices. Offers into the monthly R1 could see some initial resistance though any dips likely to be bought.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!