As US labor market gets stronger, Fed face more challenges

US job growth exceeded expectations, NFP report data showed on Friday. The figure was 224K, which is significantly higher than the consensus of 160K jobs and more than three times the value for the previous month (72K). Strengthening of the labor market triggered a reversal of chances for the Fed’s bearish move — according to Federal Funds Futures Data. The chances of a 50-bps reduction in interest rates fell to 11%, while the cuts at 25 basic points in July were 89%. Markets have been refusing so far to trust that Fed will maintain a neutral position on July’s meeting.

The increase in jobs in July was the highest we came across since January, when the head of the Fed, Jeremy Powell, suddenly signaled Fed’s transition in the "patience" mode.

Wage growth was only 0.2%, less than the forecast of 0.3%, not reaching the desired level of Fed, which is necessary to seriously consider extending the pause in the rate change.

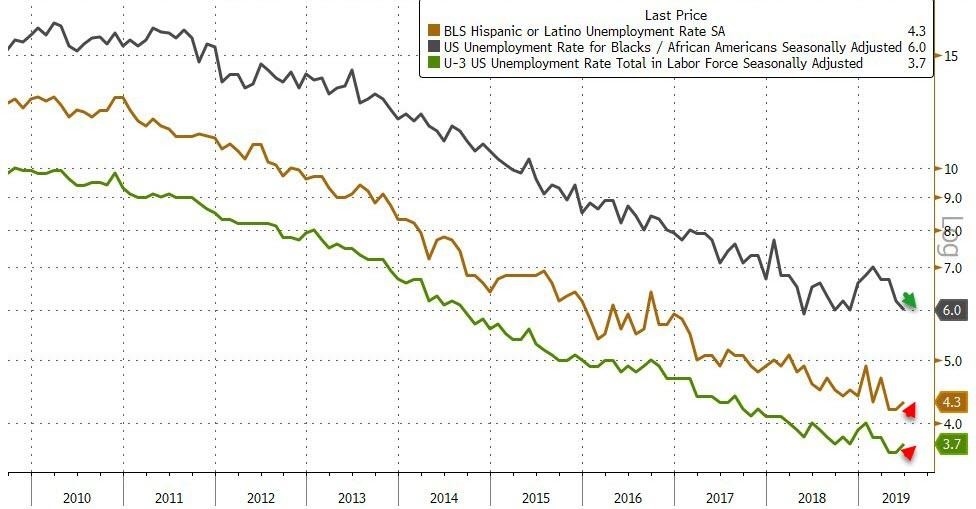

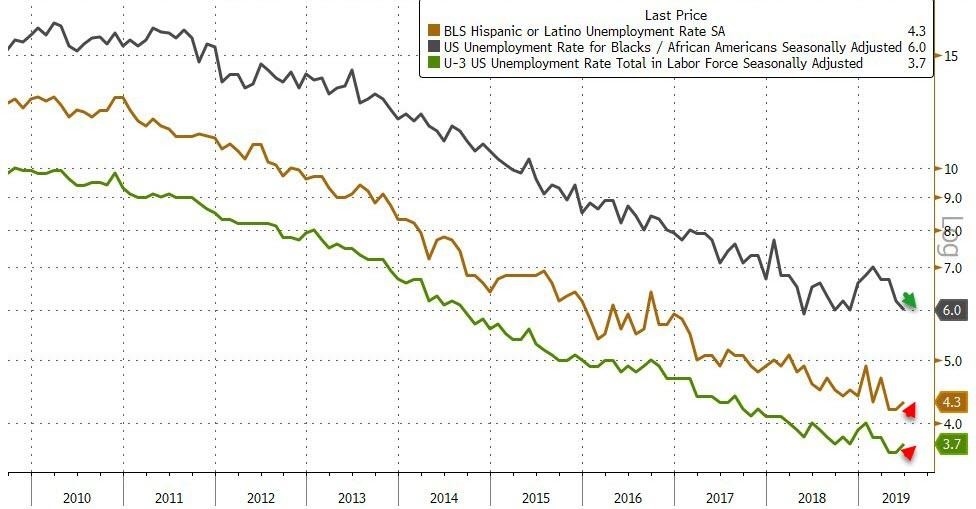

Unemployment dynamics for the population, where less-skilled labor prevails (African Americans, Spaniards) speaks about strengthening the labor market. The unemployment rate among African Americans dropped to 6.0%, and slightly increased for Spaniards to 4.3%. The overall unemployment rate changed from 3.6% to 3.7%.

Source: Zerohedge

Despite another pretext for Trump to boast about strong labor market and extension of the longest US economic expansion in history, his call for lower rates will definitely. meet more obstacles from Fed’s officials.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.