Bitcoin On Watch As Trump Signs Reserve Order

Crypto Summit Today

Alongside the release of the latest US jobs data today traders will be watching incoming news flow around the much-anticipated crypto summit at the White House. Speculation is rising on the back of news last night that Trump signed an executive order creating a US Strategic Bitcoin Reserve, detailing for the first time the governments current BTC holdings which sits at roughly 200,000BTC. The executive order outlines plans to amass more Bitcoin and other crypto assets in coming years. However, the reason that we haven’t seen Bitcoin prices surging on the back of the news is due to the details in the order.

‘Budget Neutral’ Approach

Trump notes that BTC acquisition under the reserve will be ‘budget neutral’, meaning that the government won’t be buying BTC or other coins outright. This approach is far less bullish than traders had been anticipating and has far less of an impact on the demand outlook for BTC. Currently the government’s Bitcoin holdings comprise mostly assets acquired through seizures. Looking ahead, traders will be waiting to hear more details on Trump’s plans for the reserve.

Two-Way Risk Today

Looking to today’s crypto summit, which be hosted by Trump and attended by several high-ranking members of the crypto community, there is plenty of two-way risk. If Trump gives further detail on the reserve and its acquisition plans, this could be firmly bullish for the market. Traders will be looking for some concrete details to drive fresh buying. On the other hand, if the summit is merely a PR exercise and delivers little of interest, Bitcoin prices are likely to fall back sharply as traders react with disappointment.

Technical Views

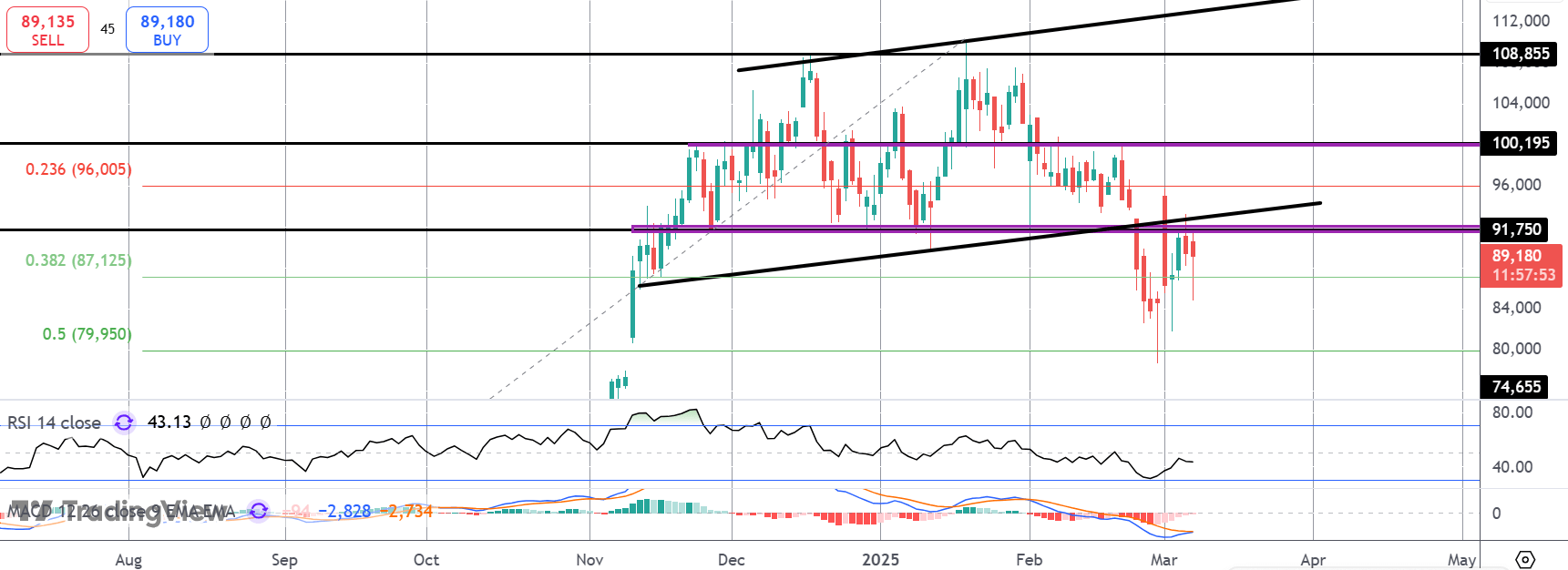

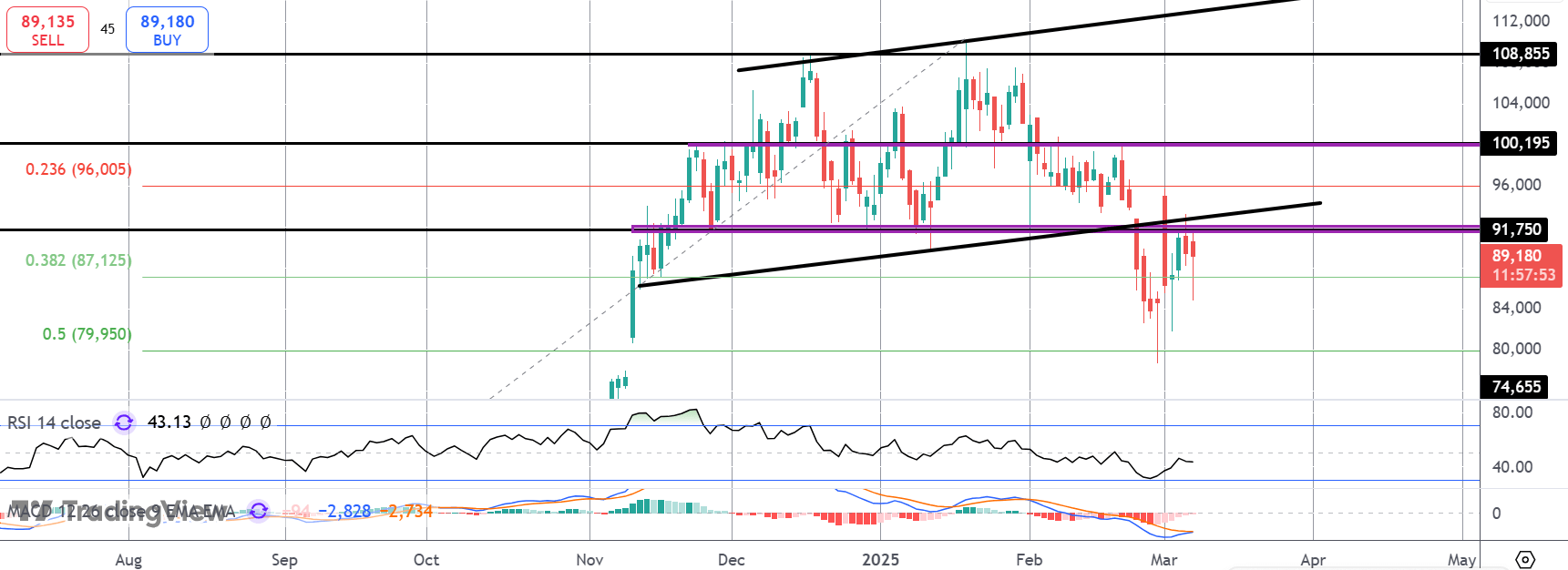

BTC

For now, BTC is caught between support at the 38.2% fib level and resistance at retest of the broken bull channel and the $91,750 level. Given the large bullish tails we’ve seen on some recent candle, the focus is on a continued recovery higher here and an eventual test of the $100k mark which bulls need to overcome to alleviate near-term downside risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.