Bitcoin Rallying on Weaker Tariff Risks

BTC Gaps Higher

Bitcoin prices are pushing higher today with the market rallying amidst a perceived lessening in trade tariff risks ahead of the upcoming US tariff deadline on April 2nd. Traders are responding to reports that the April 2nd tariffs could be milder in scope than previously signalled with some countries exempt from levies and some receiving smaller tariff amounts. The news is seeing a general pickup in risk appetite which is feeding into better demand for Bitcoin on Monday. The futures market was seen gapping higher this week at the open and is now up around 4% from Friday’s close.

Reduced Tariff Risks?

The reports from news providers such as Bloomberg and WSJ suggest that Trump will avoid sector specific tariffs while still applying reciprocal tariffs against major trading partners. However, some countries are now expected to be spared the tariffs while some will face lower tariff amounts. The news, if confirmed on April 2nd, is expected to reduce recession risks in the US and is currently being cheered by investors. If this narrative gains traction over the week and we don’t hear any pushback form the White House, Bitcoin stands to rally further as risk sentiment improves.

Institutional Demand

Indeed, if weaker tariff action comes to pass, this could act as a bullish catalyst or BTC marking the return of broader institutional demand through ETF inflows. ETFs have seen major outflows over recent months though with BTC looking to build a base against current lows, demand from the mainstream finance sector is returning with last week marking the first week of net inflows after 5 weeks of net outflows.

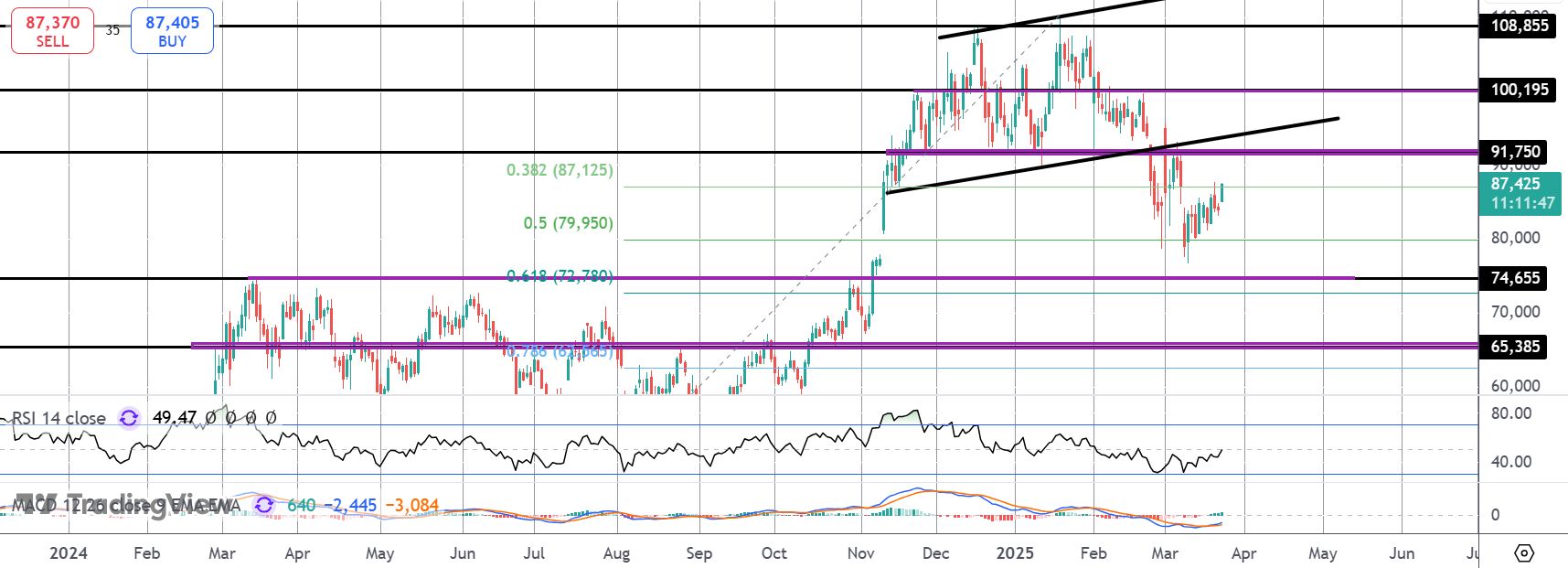

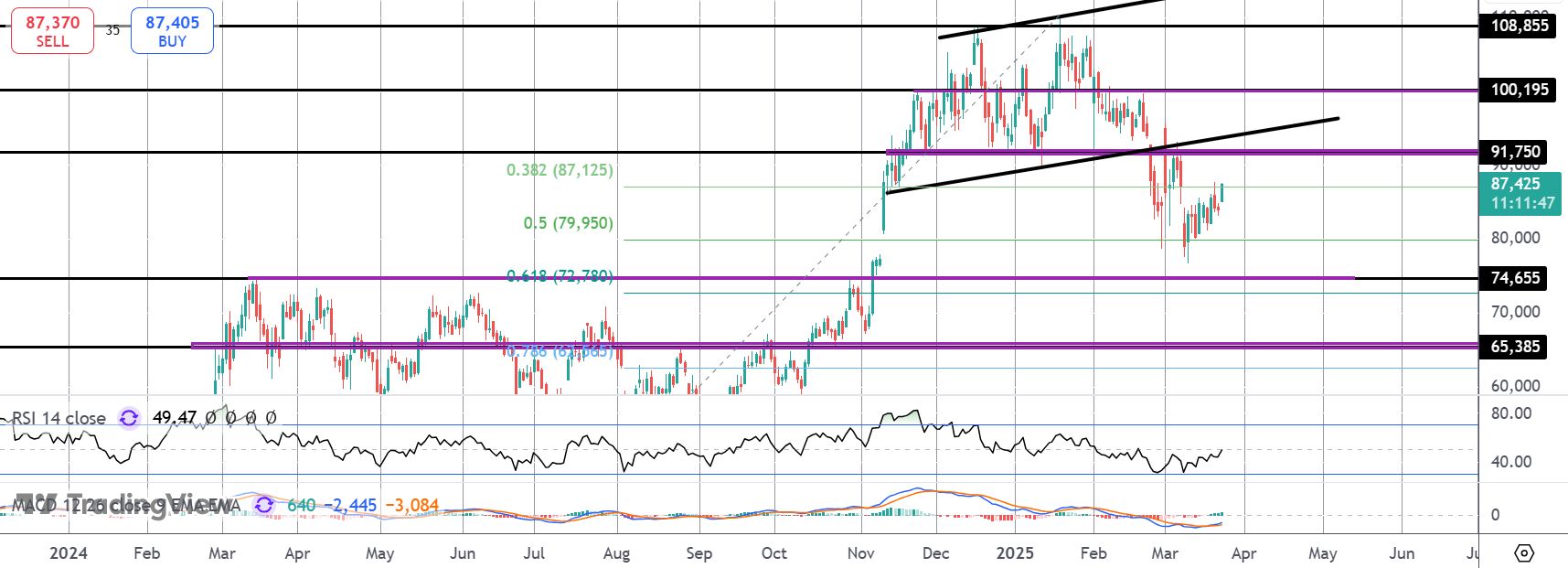

Technical Views

BTC

BTC is once again retesting the broken 38.2% fib level which capped the rally last week. With momentum studies turning higher here, focus is on a continued push though big resistance sits overhead at the 91,750 level and the retest of the broken bull channel. For now, the rally off the 80k mark remains corrective looking until we get back above that region with risks of a fresh urn lower still seen. Below 80k, 74,655 will be next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.