Bitcoin: The Calm Before The Storm?

BTC Holding Steady For Now

Bitcoin prices remain muted ahead of the weekend with the futures market having settled into consolidation mode following an initial move higher on Monday. BTC rose to its highest price since January on Monday, bolstered by news of the US/China tariff reduction deal. Both countries agreed to heavily reduce tariffs for 90 days to allow for fuller negotiations aimed at delivering a long-term trade deal. However, optimism quickly faded and the market failed to follow through with BTC slipping from its weekly highs, though remaining above the $100k mark for now. This is seen as a key pivot for the market with the bullish outlook remaining while price holds above that level. Looking ahead, any further positive updates on US/China trade should help drive prices higher again.

Institutional Demand Soaring

Despite the consolidation this week, Bitcoin ETFs have continued to see soaring inflows as institutional demand grows further. BlackRock continues to top the ETF charts, recording $410 million in inflows yesterday, a sign that smart money is anticipating higher prices in BTC. Indeed, Michael Saylor (Strategy fund) has reaffirmed his commitment to staying long the crypto asset, calling for BTC to be worth $1 per coin in 10 years’ time. Over Q1 the number of institutional traders buying into BTC ETFs has grown by 20%, with that figure expected to grow further over the year with Goldman Sachs currently the largest holder of BlackRock’s ETF.

Technical Views

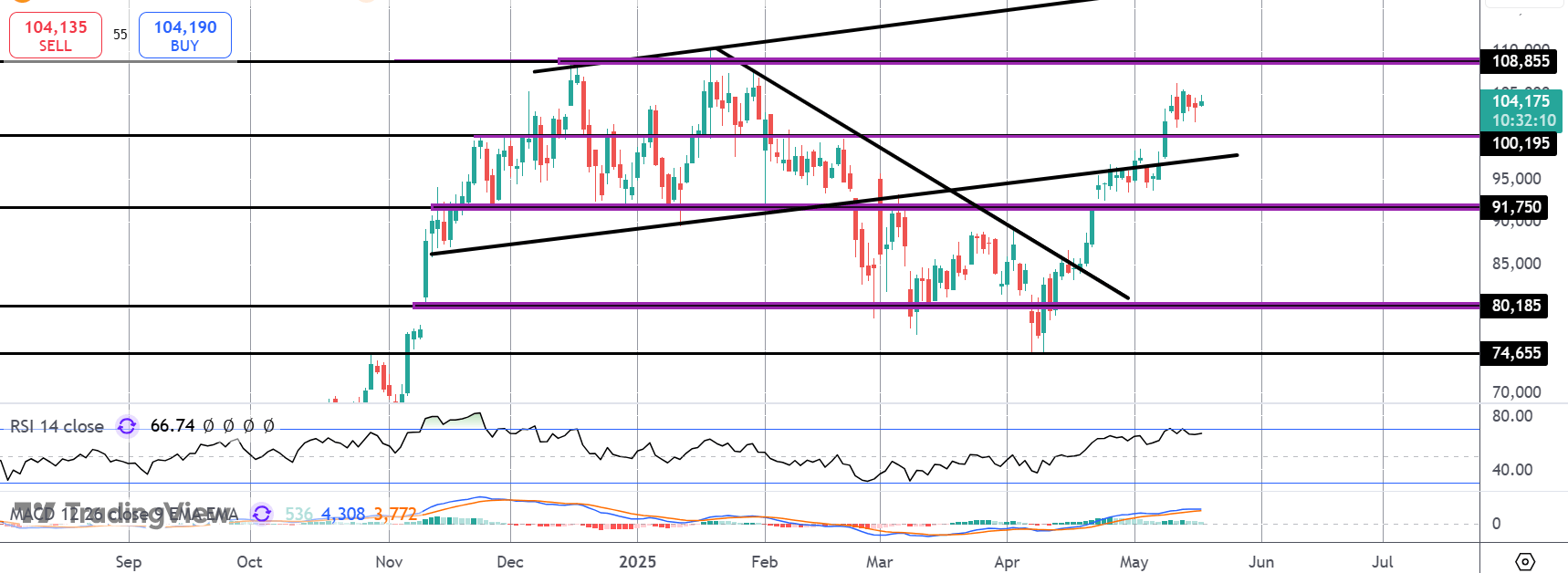

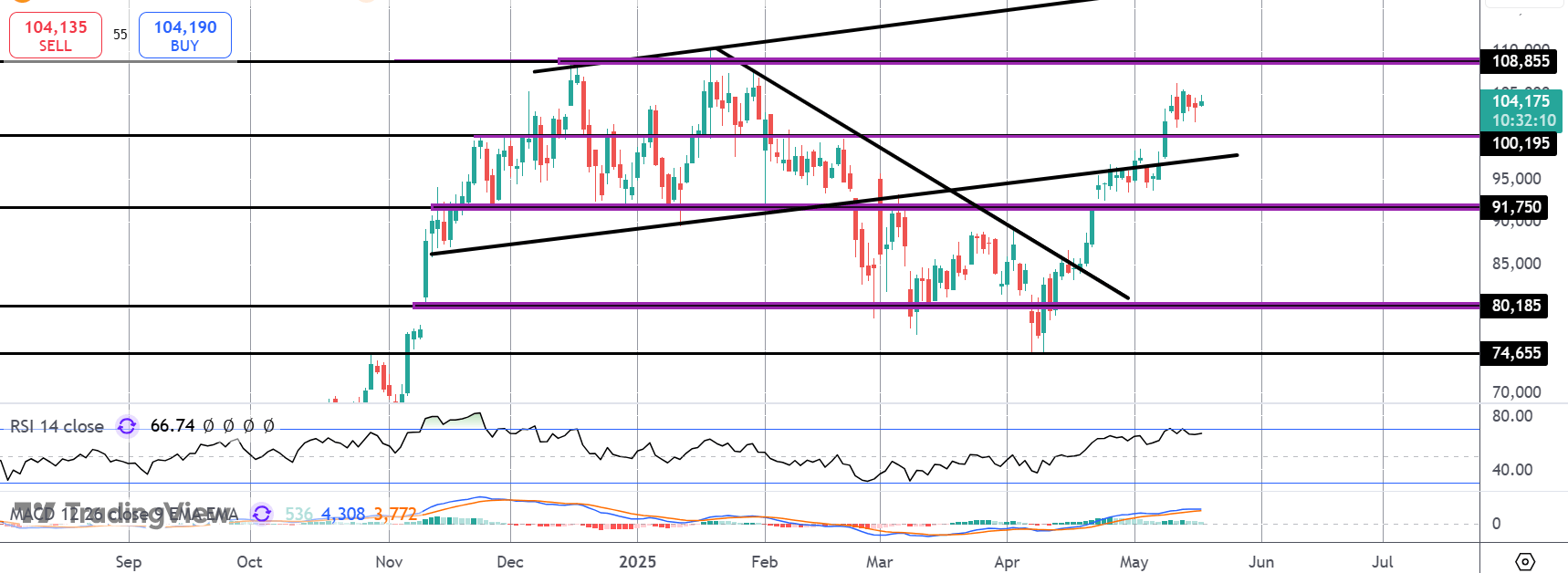

BTC

The rally in BTC has stalled for now following the break back above the $100k level. While price holds atop this level, however, focus is on a continuation higher and a test of the $108,855 highs next. Below $100k, $91,750 remains the key support to watch, with the bull channel lows ahead of that area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.