Copper Breaks Out on Trump Tariff Shock

Trump Accelerates Copper Tariff Plans

Copper prices broke out to fresh all-time highs today with the futures market surging above the 5.2015 level set in 2024 to print new record highs of 5.3740. Selling has since kicked in causing some softening in price though the focus remains on further upside while price holds above the 5.2015 level. The driver behind the breakout move is a shift in tariff risks following news that Trump will push ahead with copper restrictions in the coming weeks. The tariff plans laid out previously for copper were not expected to take effect until later in the year. However, with trump now accelerating his plans the market is ramping up and looks set to remain supported near-term as demand rises.

Copper Demand Surging

News of the incoming tariffs has sparked a surge in US copper imports with traders looking to increase inventories ahead of the tariffs taking effect. Industry data points to shipments of more than 500k tonnes, well above the typical 70k monthly average. The increase in demand comes at a time when copper producers are struggling to maintain supply levels, mainly due to issues with plant repairs and closures in Chile, the largest global copper producer. This week, Glencore noted it had to temporarily suspend exports from its Altonorte smelter as a result of required repairs, putting further strain on supply levels.

Technical Views

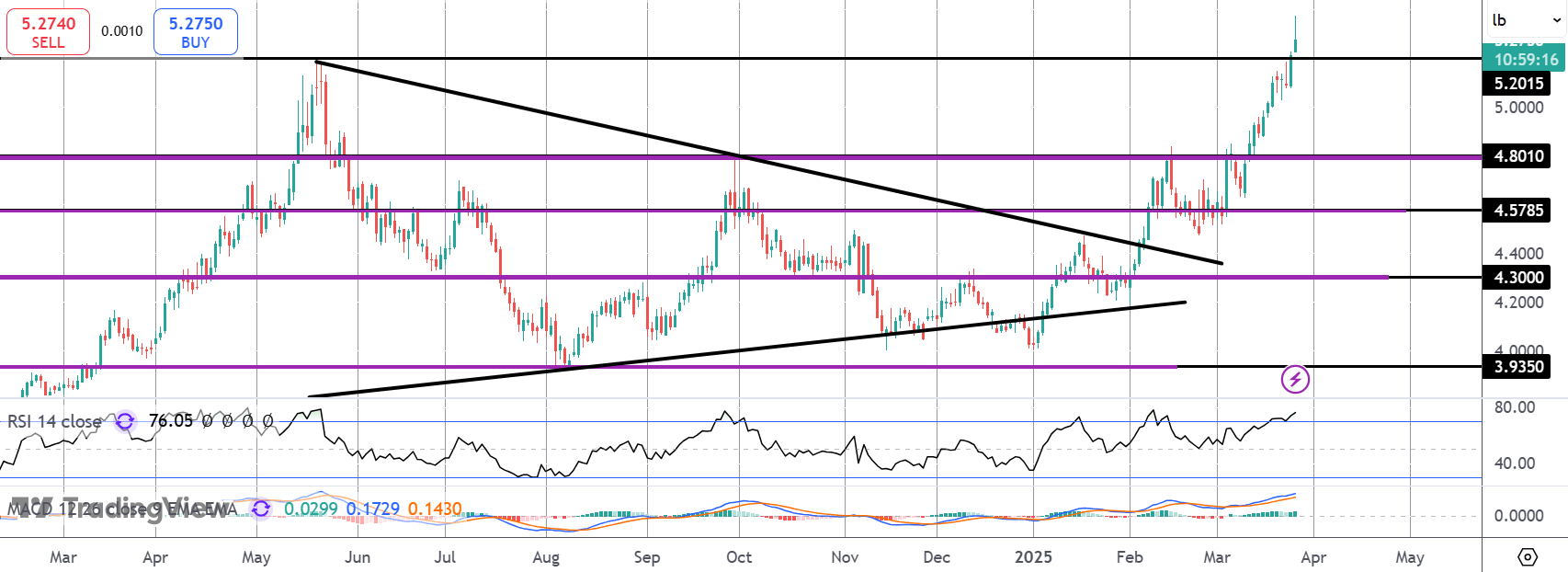

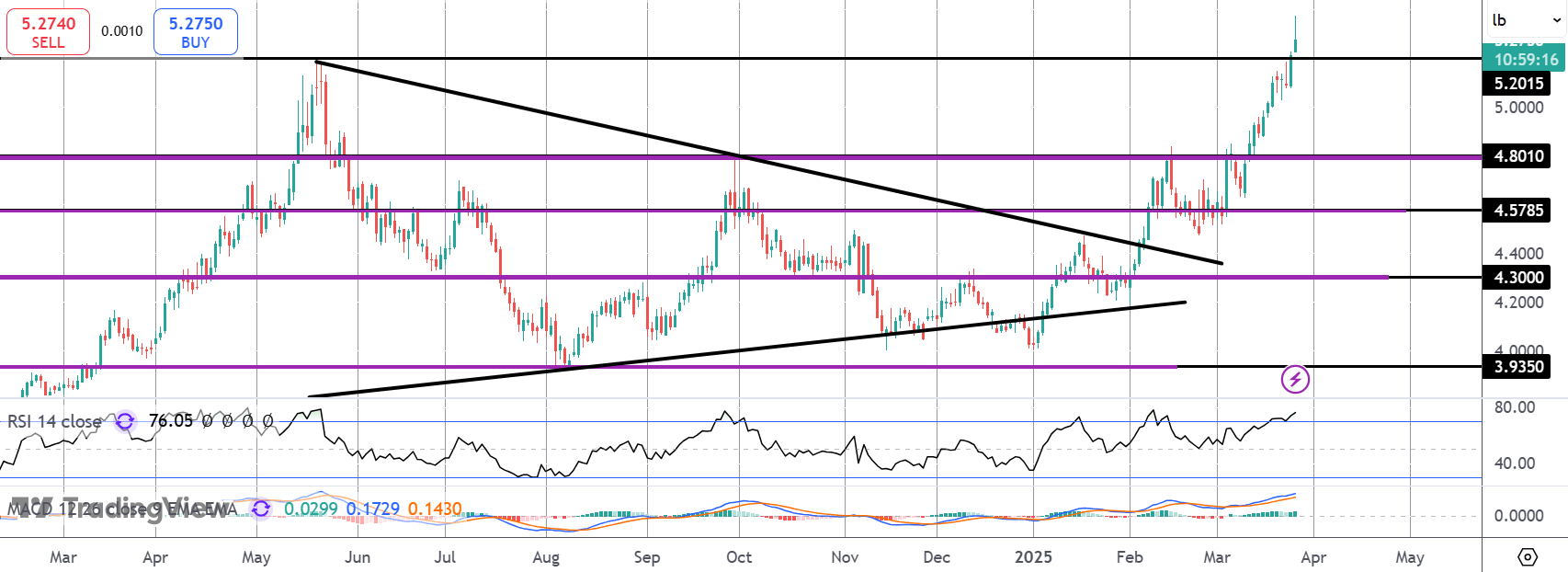

Copper

The rally in copper prices has seen the market breaking out above the 5.2015 level, peaking just ahead of the 5.40 level. The market is currently pulling back though the bull outlook remains while we hold above 5.2015, in line with bullish momentum studies readings. Below that level, 4.8010 is the main support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.