Copper Hits New All-Time Highs As USD Tanks

Copper Breaks Out

Copper prices are on watch today after the futures market soared to fresh all-time highs. Rising geopolitical risks, uncertainties around global trade and a weaker USD have sparked a surge in demand for copper. The metal had been lower in recent weeks as demand concerns kicked in following the rally over Q4 and early January. A crackdown on HFT speculation in China had also seen prices pulling back form prior highs, feeding into bearish sentiment. However, those issues have seemingly disappeared for now as broader macro themes take centre stage.

Trump Threatens Iran

A fresh threat from Trump against Iran this week has sparked volatility across markets and while safe havens such as gold, JPY and CHF are soaring, copper prices have found fresh upside also. Part of this is down to fluctuating threats from Trump around fresh trade tariffs, keeping risks of an escalating trade war alive, as well as his support for a weaker Dollar which has materialised this week. USD has plunged amidst anti-USA investor sentiment and speculation that the Fed and BOJ engaged in joint intervention at the end of last week, fuelling a sharp rally in JPY.

Bullish View

Looking ahead, copper prices look poised to remain bullish with recent indicators reflecting market tightness in China and USD vulnerable to continued downside. Only a big change on the global macro front is likely to unseat copper prices near-term.

Technical Views

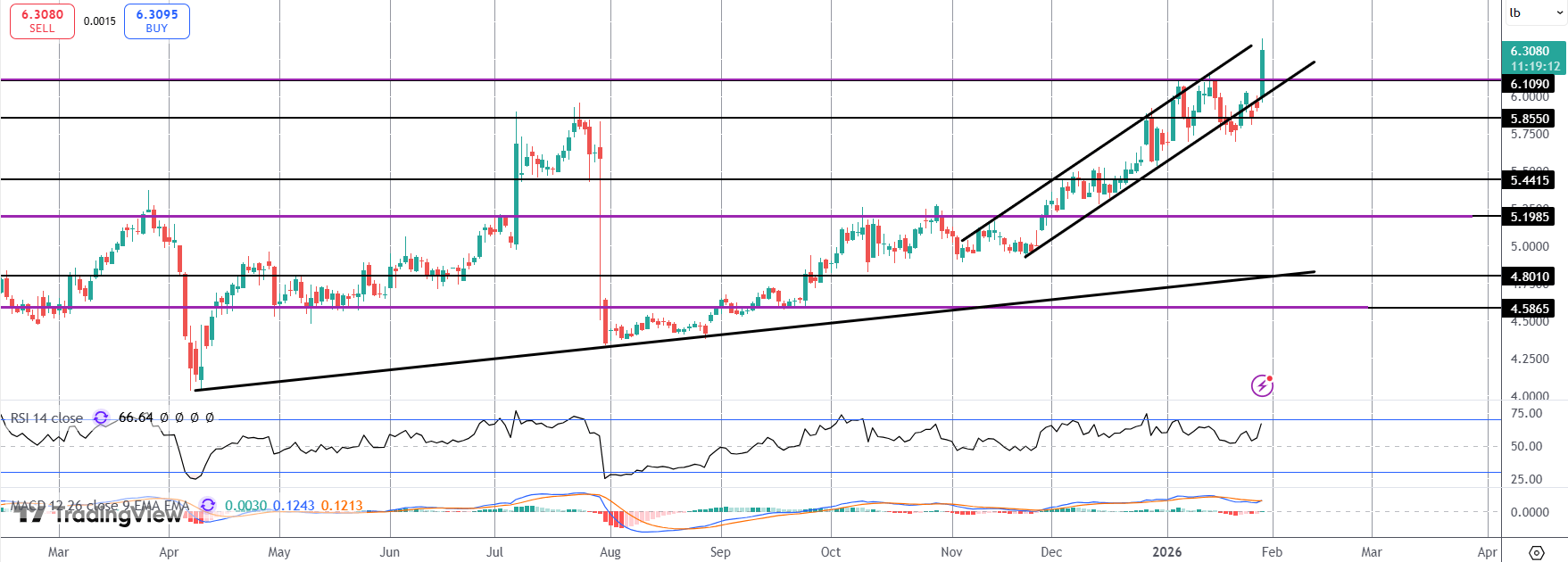

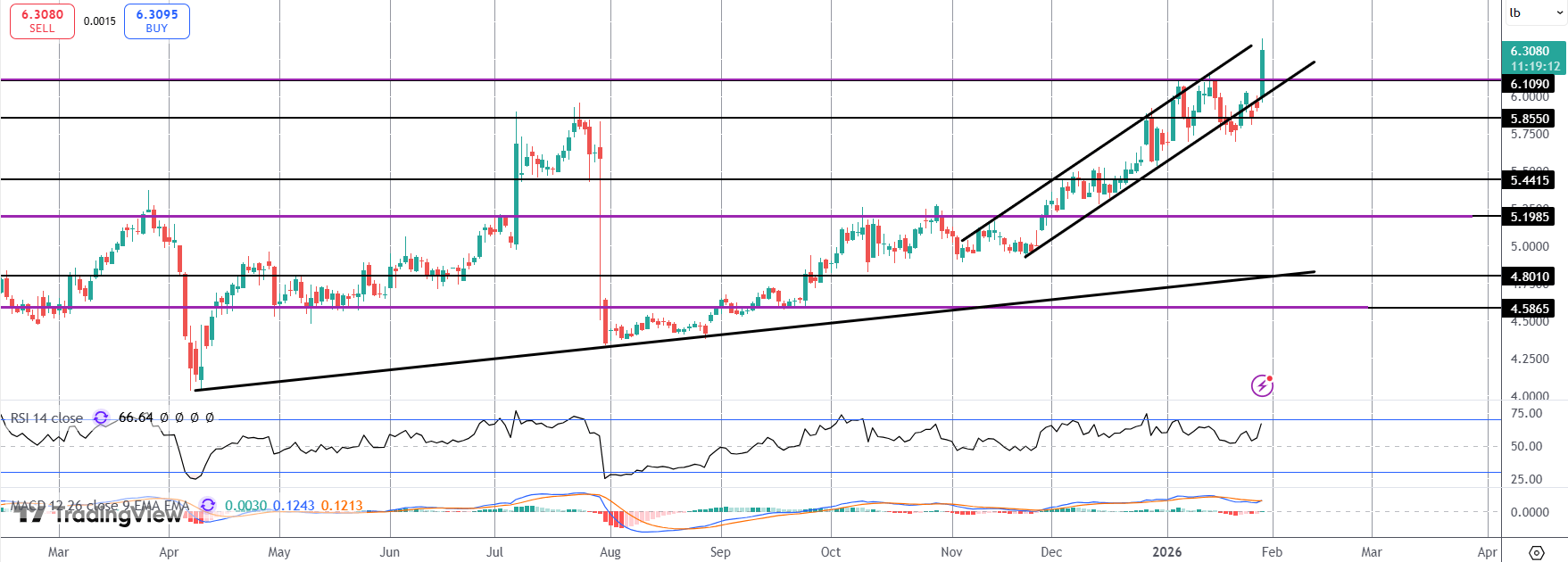

Copper

The rally in copper has seen the market breaking out above the 6.1090 level resistance and now testing the bull channel highs where price is currently stalled. With momentum studies turning higher, focus is on continued upside while above 6.1090. However, we are seeing clear bearish divergence here so traders should be wary of any reversal patterns form.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.