Dollar Focus Turns to Inflation This Week

NFPs Rise Along with Unemployment

The US Dollar remains congested and directionless aw we start the new week. Friday’s jobs data was a mixed bag with the headline NFP reading rebounding to 228k from just 12k the prior month, above the 128k the market was looking for. Additionally, wage growth was seen holding firm at 0.45, despite expectations for a drop to 0.3%. Finally, the unemployment rate was seen unexpectedly rising to 4.1%, above the prior and expected 4.1% level.

Limited USD Moves

The market reaction in USD was muted, despite December rate cut projections jumping on the back of the data to almost 90% from around 70% prior. The jump in the unemployment rate looks to have overshadowed the lift in the NFP reading. However, the lack of follow through in FX markets is interesting to note and shows that near-term, USD upside risks remain.

US Inflation Due Next

Looking ahead this week, focus will now turn to the incoming US inflation data on Wednesday. Both core and headline are expected to tick up slightly. Given the current pricing, a small lift should derail a further cut from the Fed. However, if we see core inflation beating forecasts, rising to 0.4% MoM, this could certainly raise some serious questions over whether the Fed should ease again here. As such, there are bullish risks for USD this week into that data.

Technical Views

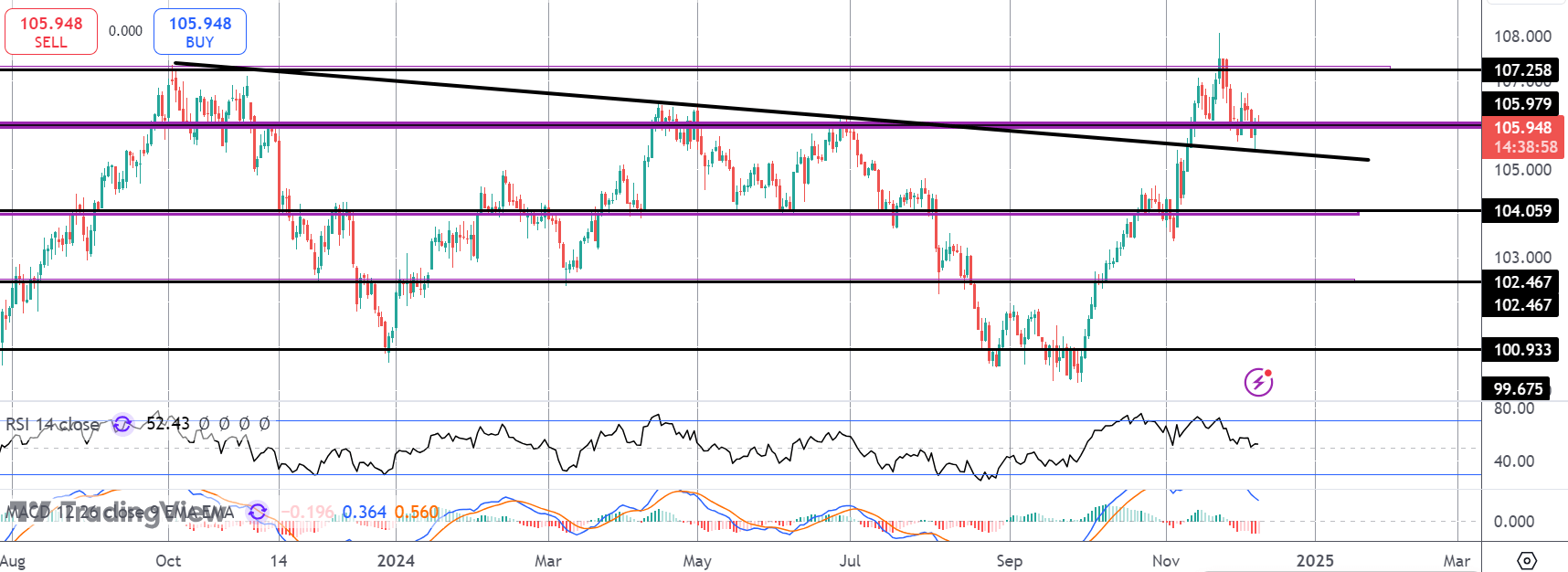

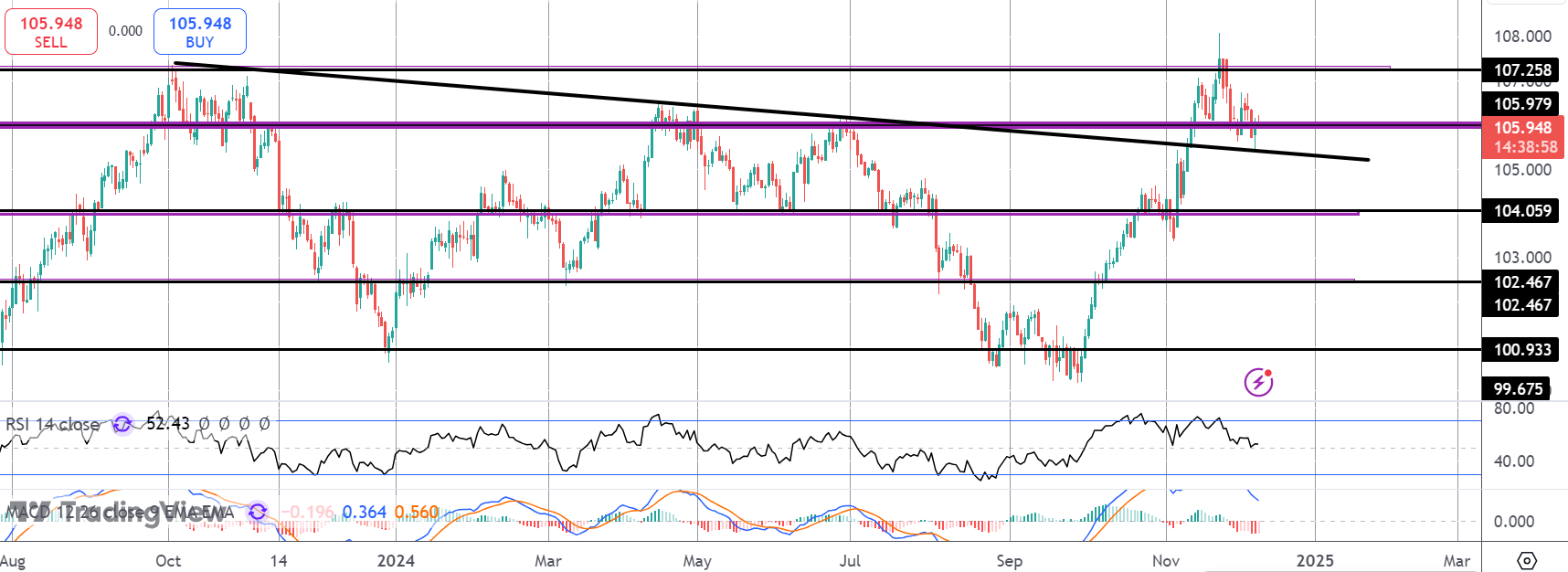

DXY

The rally in DXY has stalled for now into the 107.25 level with the market since reversing lower to test the 105.97 level support and the broken bear trend line. While this area holds, focus is on a further push higher. Below here, however, focus turns to 104.05 as the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.