Dollar Rises, Gold Falls as US CPI Report Leaves Investors Uncertain

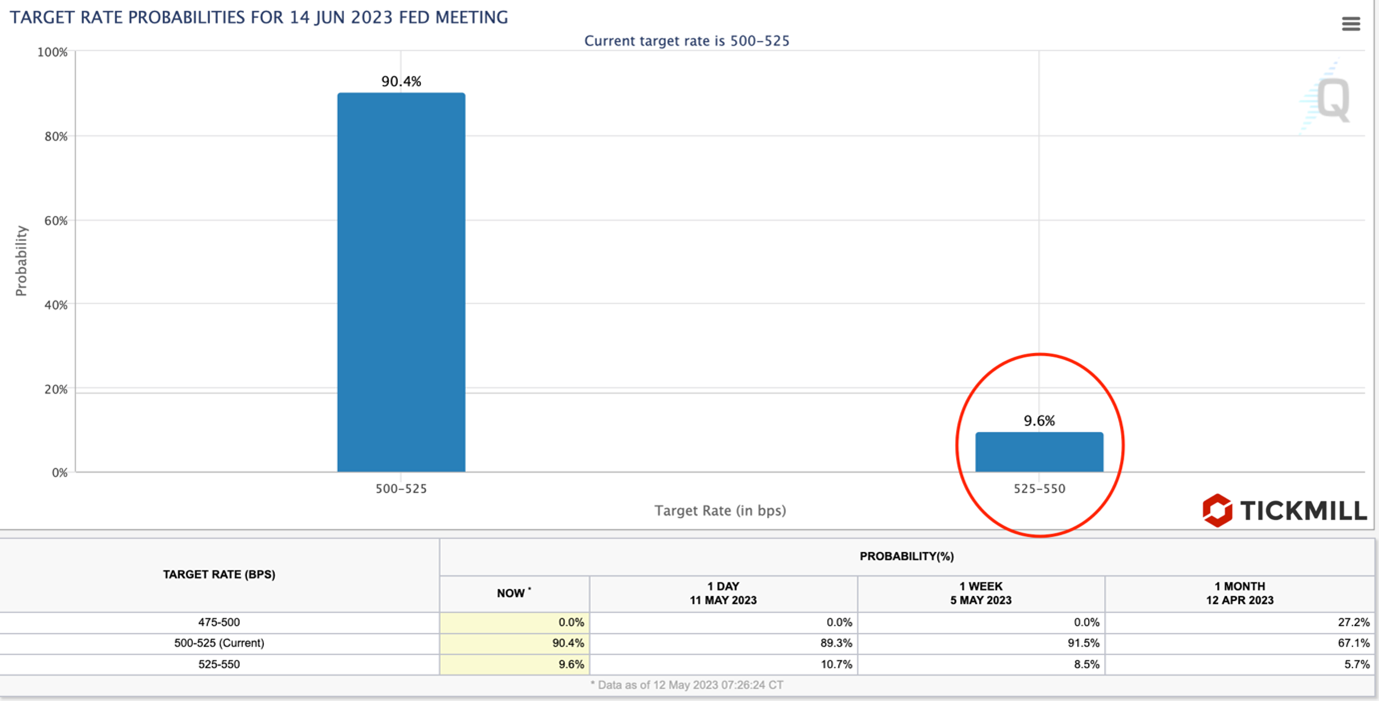

On Friday, the dollar continued to gain ground, while the price of gold dropped to $2000 per ounce. This occurred as the details of the US Consumer Price Index (CPI) report for April failed to fully convince investors that the Federal Reserve would refrain from raising interest rates in June. Additionally, the argument regarding lower-than-expected producer price inflation in April (0.2% compared to the anticipated 0.3%) proved insufficient to cement expectations of the Fed pause in June. Consequently, Treasury yields rose, and the likelihood of a rate hike in June increased to 10%. Earlier this week, the probability stood below 2%:

Looking ahead to next week, particular attention will be given to retail sales and industrial production data in the US. The recent CPI data indicated a significant surge in prices for used cars (4.4% month-on-month), which is expected to be reflected in retail sales.

Several speakers from the Federal Reserve are scheduled to present their viewpoints on the state of the American economy next week. Their objective will be to shape market expectations regarding potential interest rate cuts throughout the year, emphasizing the presence of high and sustained core inflation as well as a robust labor market. The uncertainty surrounding the US banking system will continue to influence market sentiment as investors grapple with the impact of recent tightening of borrower requirements by banks and reduced credit availability on economic activity.

In the coming week, housing sales data will also be released, and it is anticipated that they will soften due to a decline in mortgage applications. Another area of interest will be the initial jobless claims, which are expected to rise once again in response to a decrease in the number of job openings, as indicated by the Job Openings and Labor Turnover Survey (JOLTS) data.

Regarding the UK economy, the Bank of England has made it clear that the decision to raise rates in June will depend on wage behavior and consumer inflation. The corresponding reports will be released prior to the central bank's meeting. Wage data has recently exhibited volatility, with last month's surprising rapid wage growth following several months of more modest figures. Another wage reading will be available on Tuesday, but the bank's own business survey suggests a slowdown in wage growth. If next week's data confirms this deceleration and services inflation remains moderate, the pound will likely take a pause in the central bank's tightening cycle. In such a scenario, GBP/USD will face challenges in returning to the 1.26 level. It is worth noting that the British currency has encountered strong resistance in the form of a medium-term bearish trendline, making it difficult to overcome it swiftly without a retracement:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.