Eurozone Economic Outlook: Positive Trends and Market Dynamics

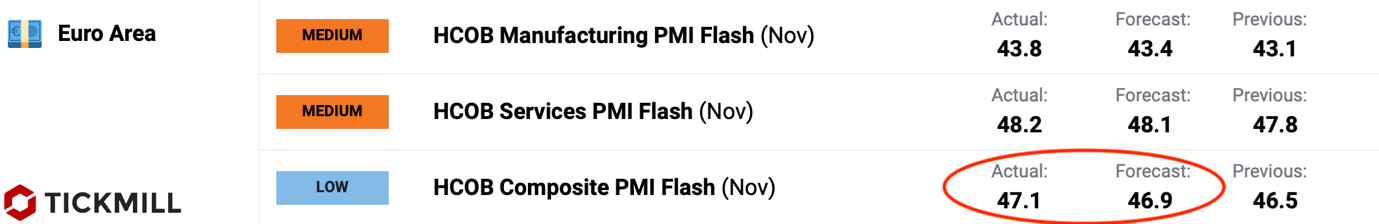

The activity indices for the services and manufacturing sectors in the Eurozone, published on Thursday, pushed EURUSD back into the range of 1.09-1.0950. The released data exceeded expectations overall, setting the stage for positive expectations in the future:

Concerns about stagflation in the EU, highlighted by data in September and October, appear to have subsided. The market is now leaning towards the notion of a 'soft landing' for the European economy, involving reduced inflation without significant harm to real output. The British pound continues to strengthen against the dollar, with a breakthrough of the 1.26 level on the horizon. The shortened trading day this Friday contributes to sluggish movements in major European indices, futures on U.S. indices, and the currency market.

Later today, U.S. PMI data will be released, and the market, in search of a turning point in U.S. expansion, will likely react strongly to the data. However, surprises in the data are unlikely to spur enough trading activity to witness breakthroughs in local highs and lows in the currency market, particularly the exit of the dollar index (DXY) from the range of 103.50-104.

If the downward movement of the dollar index resumes, we may observe a potential turning point or the emergence of strong support based on the technical chart on the daily timeframe. This would align with the upper boundary of the previous bearish trend of the dollar, corresponding to the range of 102-102.50:

News of OPEC disagreements in coordinating production quotas and the Israel-Hamas truce is driving oil prices on a downward trajectory. WTI spot prices are stabilizing in the range of $76.50-77 per barrel, the lowest level since mid-summer. Concerns about supply disruptions are decreasing, and the market is also factoring in the risks of a shift in balance towards overproduction due to the lack of consensus in OPEC. Meanwhile, the situation on the global demand side for oil has not changed significantly. As a result, investors are increasing demand for currencies that were recently under pressure due to stagflation risks and expectations that their trade balances will worsen due to expensive energy sources – EUR, GBP, JPY, as well as several other Asian currencies. Consequently, there is a risk of correction in them if OPEC agrees in a way that exceeds current expectations in its announced efforts to control production. This is one of the bearish factors for the currencies of countries importing energy resources, which is worth considering.

Additionally, investors are currently monitoring the situation in the Chinese property market. According to some reports, the Chinese authorities have instructed banks to issue unsecured loans to developers with good ratings, emphasizing the level of concern about the situation on the part of the authorities. Undoubtedly, if the measure is adopted, investors will become more confident in buying the Chinese market, increasing their risk appetite in equity markets of other countries.

The data released today from the IFO on the German economy generally met expectations. Together with yesterday's PMI data, the report created a strong impression that the ECB is taking control of the situation, as the combination of the pace of economic expansion and inflation, according to incoming data, is moving in the optimal direction.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.