Follow The Flow: GBPCHF Testing Key Support

GBP Falls on Soft UK Data

GBPCHF is on watch today with the retail market holding a more than 80% long position in the pair. We’ve been trending lower since the early April highs and the current backdrop looks favourable for further shorts near-term. GBP is on the ropes following the latest UK data which showed retail sales falling into negative territory last month. Given the current growth fears in the UK, the data has caused a sharp unwinding of GBP longs. On the back of hotter-than-forecast UK inflation earlier in the week, the near-term outlook for GBP has grown more dim. Additionally, the fall back in risk appetite into the end of the week has seen CHF rallying on increased safe-haven inflow.

CHF Rallying on Safe Haven Demand

With attention shifting to the forthcoming FOMC meeting and expectations of further Fed tightening, the current dynamic looks likely to continue. US earnings have also grown more mixed in recent days with earnings undershoots from big names such as Tesla and Goldman Sachs adding to the risk off tone. While stocks continue to retreat, expect CHF to remain well supported keeping GBPCHF risks skewed to the downside for now.

Technical Views

GBPCHF

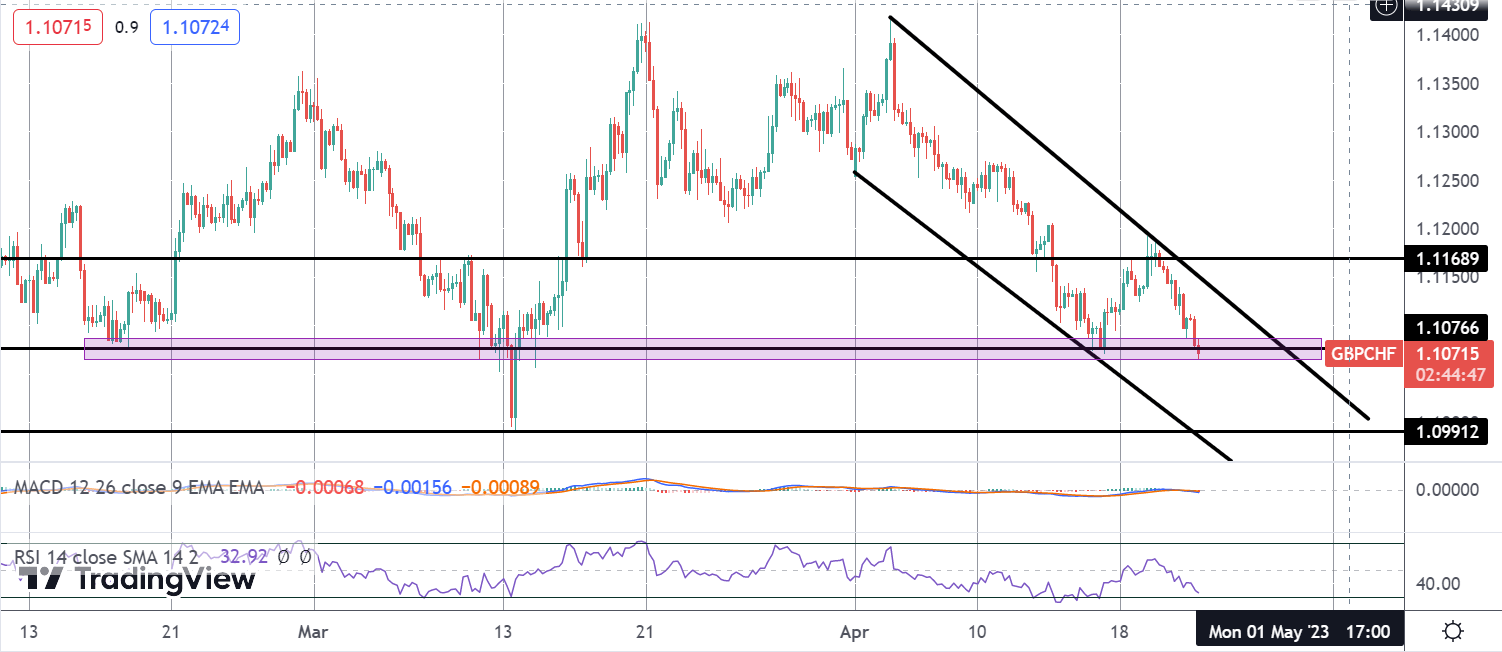

The decline in GBPCHF has been framed by a well-defined bear channel. Price is currently testing a key support level along the 1.1076 area. With momentum studies bearish, the focus is on a break of this area and continuation of the channel down towards next support at the 1.0991 area. To the topside, bulls need to break above 1.1168 to affect a shift in momentum.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.