Market Spotlight: Trading AUDCAD Around Today's BOC

BOC In Focus

The Bank of Canada will be in focus today as it meets for its December monetary policy decision. There is a great deal of attention on today’s meeting given the market expectation that the BOC could well signal a pause in its tightening program. While a further .5% of tightening is expected today, this will bring rate sup to 4.25%, the BOC’s own projected peak rate. With this in mind, the market is looking for the bank to provide guidance signalling a willingness to allow for a period of assessment of the economy on the back of the last year of tightening.

Gauging Market Reaction

If the bank satisfies this expectation, CAD is likely to weaken a little near-term as market attention diverts to other places where central banks are still pushing ahead with tightening, such as GBP and NZD. However, if the bank takes markets by surprise and signals that further rate hikes will likely be necessary, lifting its peak rates projection, this will likely fuel a swift wave of CAD buying, particularly in places where the currency has been depressed recently.

Technical Views

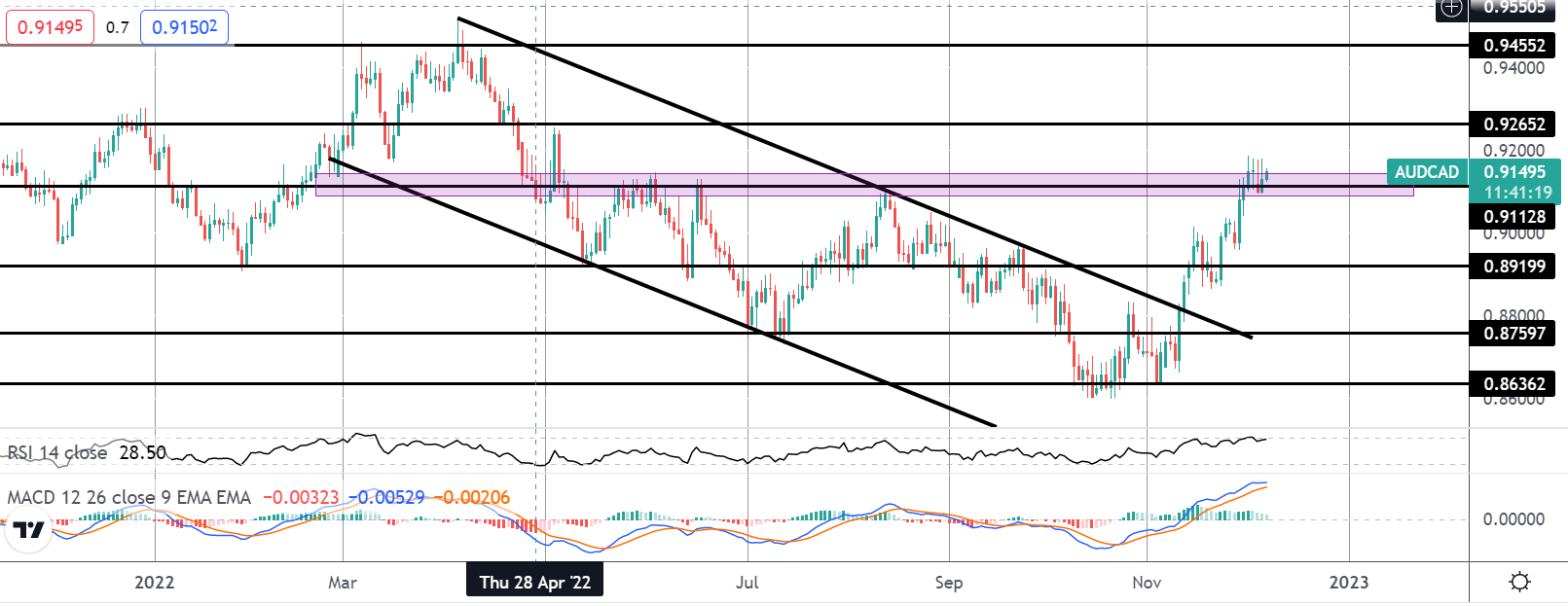

AUDCAD

If the BOC does surprise markets today by extending its tightening cycle, a great candidate for a near-term short is AUDCAD. With the RBA having pivoted on rates recently, hiking by just .25% this week, any hawkish surprise from the RBA today would likely see AUDCAD reversing sharply. Price is currently stalled around the .9112 level and if back below here, .8919 will be the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.