OPEC+ Production Cut and its Impact on Oil Prices

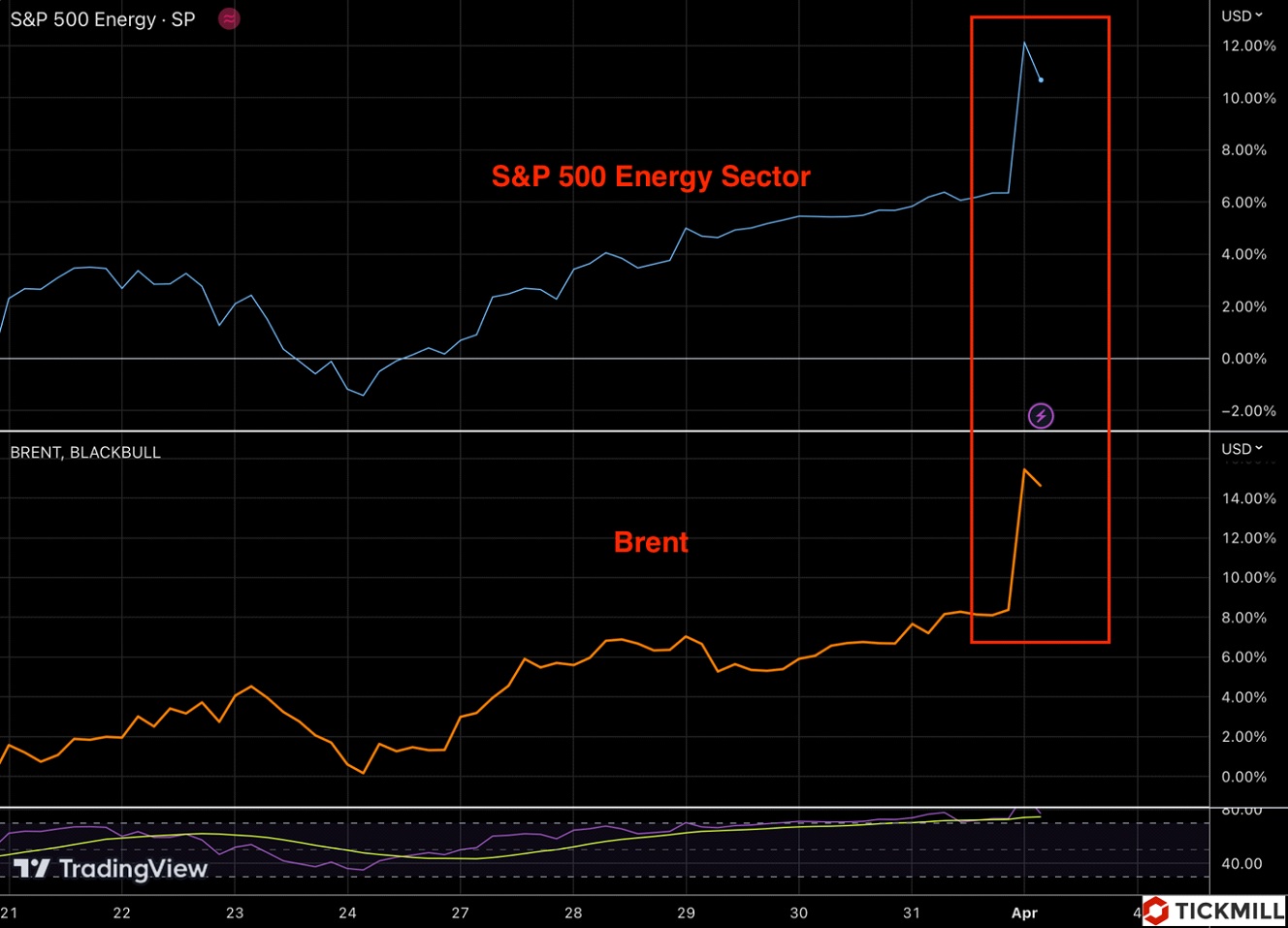

Over the weekend, some members of the oil alliance OPEC+ announced that they'll be producing less oil in the second half of 2023. This shocking news came before a joint ministerial meeting that was scheduled for today and caught the markets off guard, causing prices to jump up by over 6% and creating a frenzy in the energy sector of the stock market.

The total reduction in production by the alliance by the end of the year will be 1.66 million barrels per day. Russia accounts for 500K of that, and part of the reduction within that volume was already known to the market before OPEC+'s decision yesterday, so it was already factored into prices.

However, there's still a reduction of 1.116 million barrels per day from the other members. The production cut will be in effect from the beginning of May until the end of the year. The size of the reduction is proportional to the production levels of each participating country. For example, Saudi Arabia, whose production target is roughly equivalent to Russia's, will also be producing 500K b/d less.

These production cuts indicate that OPEC+ is not satisfied with the $70-80 per barrel Brent range. They need higher prices. Although Saudi Arabia has stated that the decision to limit production is a "precautionary measure aimed at maintaining market stability," it seems more like an attempt to maximize profits from selling oil to consumers without significant competition from shale oil. In the near term, the motive of ensuring market stability can still be understood, but the market was already expecting a deficit in the second half of this year. It's clear that this will only add volatility to the oil market when it enters a state of deficit.

OPEC+ can actually cut production without fearing losing a significant market share to non-OPEC members. In previous years, OPEC+ was afraid of raising prices too high, fearing that it would strengthen the position of shale producers. However, it is clear that the growth of US production is much more modest nowadays, with American producers changing their approach to expansion. Gone are the days when they had to extract as much as possible. Instead, capital discipline and shareholder profit seem to be the key focus now. Therefore, OPEC+ members can now try to exercise their pricing power to the fullest.

The risks of this decision are obvious - overestimating the pace of oil demand growth. The key unknown here is the recovery of the Chinese economy, which should provide the lion's share of demand growth this year. The results of the transmission of the central banks' tight monetary credit policy are also unclear, namely the impact on demand and investment components due to policy lags.

The US has already expressed their displeasure with OPEC's decision. Obviously, if prices rise significantly, we will see growing pressure on OPEC to reconsider its decision. However, as seen for most of last year, the alliance may simply ignore these calls. This leaves the US with the option to turn to the Strategic Petroleum Reserve (SPR) again, if necessary, but given that the SPR is at its lowest level since the early 1980s, using this mechanism will not be easy.

The unexpected reduction in production by OPEC member countries again puts inflation risks at the forefront. Firstly, this will lead to cost-induced inflation (as opposed to demand-induced inflation), which is less favourable for economic growth forecasts. Therefore, asset prices may also begin to reflect the increased risks of slowing economic growth in oil-consuming countries. Time will tell whether OPEC's decision has allowed them to increase their gains from selling energy resources.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.