Silver Breaks Out to 12-Year Highs

Silver Breaks Out

Silver prices are on watch today with the futures market breaking out to 12-year highs against a backdrop of a weaker US Dollar and elevated safe-haven demand. Yesterday, a significantly weaker-than-forecast ADP employment report poured cold water on the firmer JOLTS job openings data we saw a day earlier. The figure was seen at just 37k vs expectations for a 111k, down sharply down from the prior month’s 60k reading.

Weak US Data

The data came alongside a fresh contraction in the ISM services reading, the first in almost a year. Marking the weakest reading in over two years the data has fuelled fresh uncertainty ahead of tomorrow’s headline NFP data, itself expected to print a much weaker 127k from the prior month’s 177k. With Fed easing expectations moving back into the spotlight the US Dollar has moved lower, helping support metals prices.

Trade Uncertainty

Uncertainty around US trade policy remains a key driver for markets with silver and gold benefiting via increases safe-haven demand. A recent deterioration in optimism around US trade talks with China has seen safe-haven demand increasing this week and while this dynamic remains in place, silver prices look likely to continue higher near-term.

US Jobs Data

Looking ahead this week, tomorrow’s US jobs data will be the key focus for markets. If a weaker set of figures is confirmed tomorrow, this should keep USD anchored lower, while putting greater focus on Fed easing expectations, helping push silver prices higher. Only a meaningful upside surprise tomorrow is likely to dent the rally in silver at this point.

Technical Views

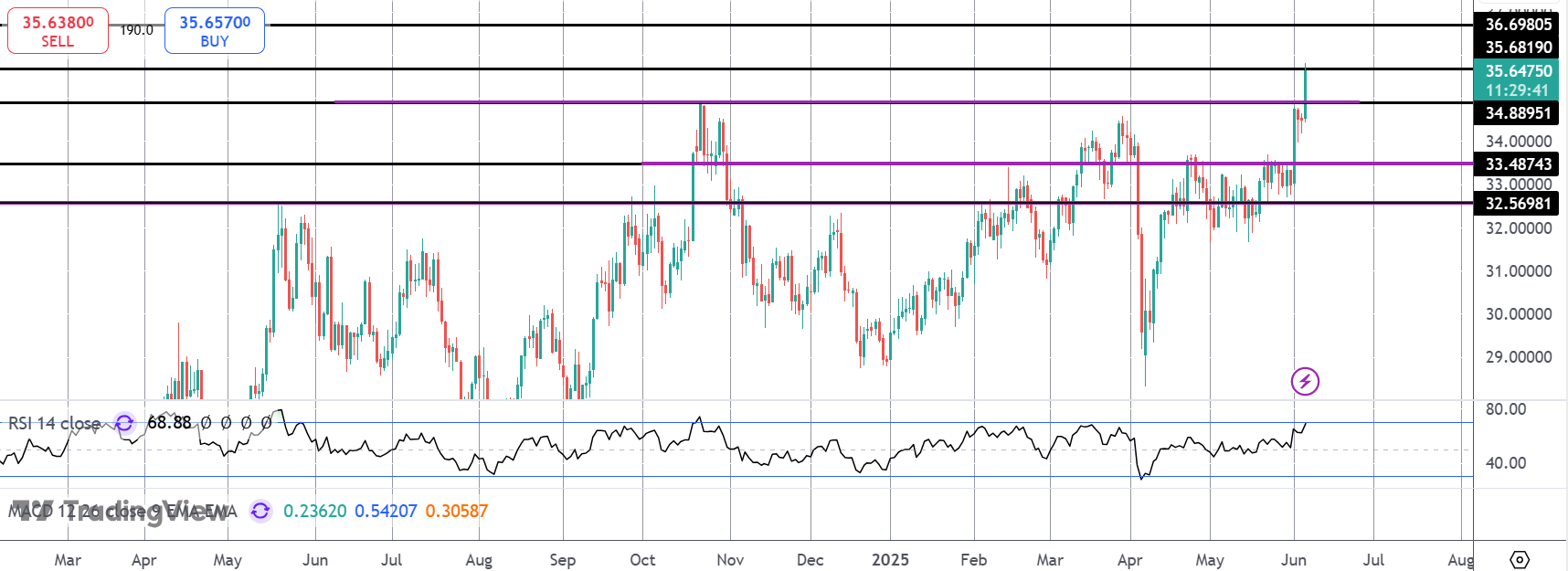

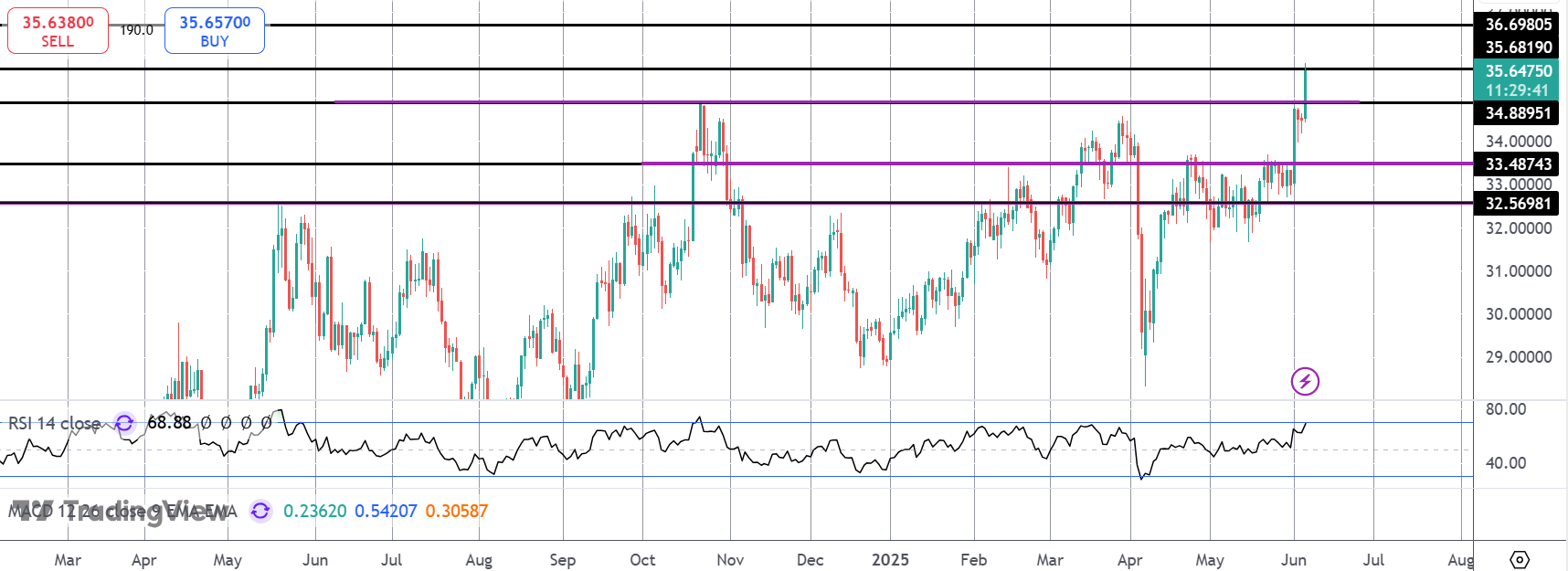

Silver

The rally in silver has seen the market breaking out above the prior 34.8895 highs with price now testing next resistance at 35.6819. Bullish momentum studies suggest price is likely to keep pushing higher here with the bull outlook intact while price holds above 34.8895.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.