The FTSE Finish Line

FTSE 100 - Financials & Miners Lead The Way To A Seventh Day of Opening Gains

The FTSE 100 continues to trade with an upbeat tone as the UK benchmark opened in the green for a seventh straight session, the early advance has faded to trade just below the flatline as London traders head for the exits with losses of circa 0.5%. On the positive side of the ledger for the day was decent support seen for financials and mining sectors, with Rathbone Group Plc popping 2.3% as the wealth management provider announced the purchase of Investec Plc UK wealth management business in an all share transaction valuing the acquisition at £839 million, this added 2.9% to Investec shares. On the negative side of the ledger a couple of notable underperformers, OKYO Pharmaceuticals plunged over 14% at the open as the bio-pharma is set to delist from the LSE at the end of the month given poor performance in trading volumes and valuation. Saga Plc shares were shunned by investors, shedding 8.3% following official confirmation that its proposed sale of its Insurance business to Australia Open had been terminated, leaving the seniors holiday group left holding a business unit that has been mired by higher claims inflation. Speaking of inflation, the Bank of England’s Tenreyro, made remarks earlier where she confirmed her dovish tilt, suggesting that a looser monetary stance was now needed, contrary to official monetary policy, which is premised on creating tighter fiscal conditions to battle inflationary pressures, Tenreyro posited that interest rates should be reduced as soon as possible, as she deems inflation to have already peaked and as such naturally heading below the banks 2% target level. Countering Tenreyo’s dovish perspective is commentary from BoE’s Pill stating that ‘given the MPC’s mandate, CPI inflation will revert to 2% over time. But it is taking longer to return to target than was originally expected, and longer than is desirable’.

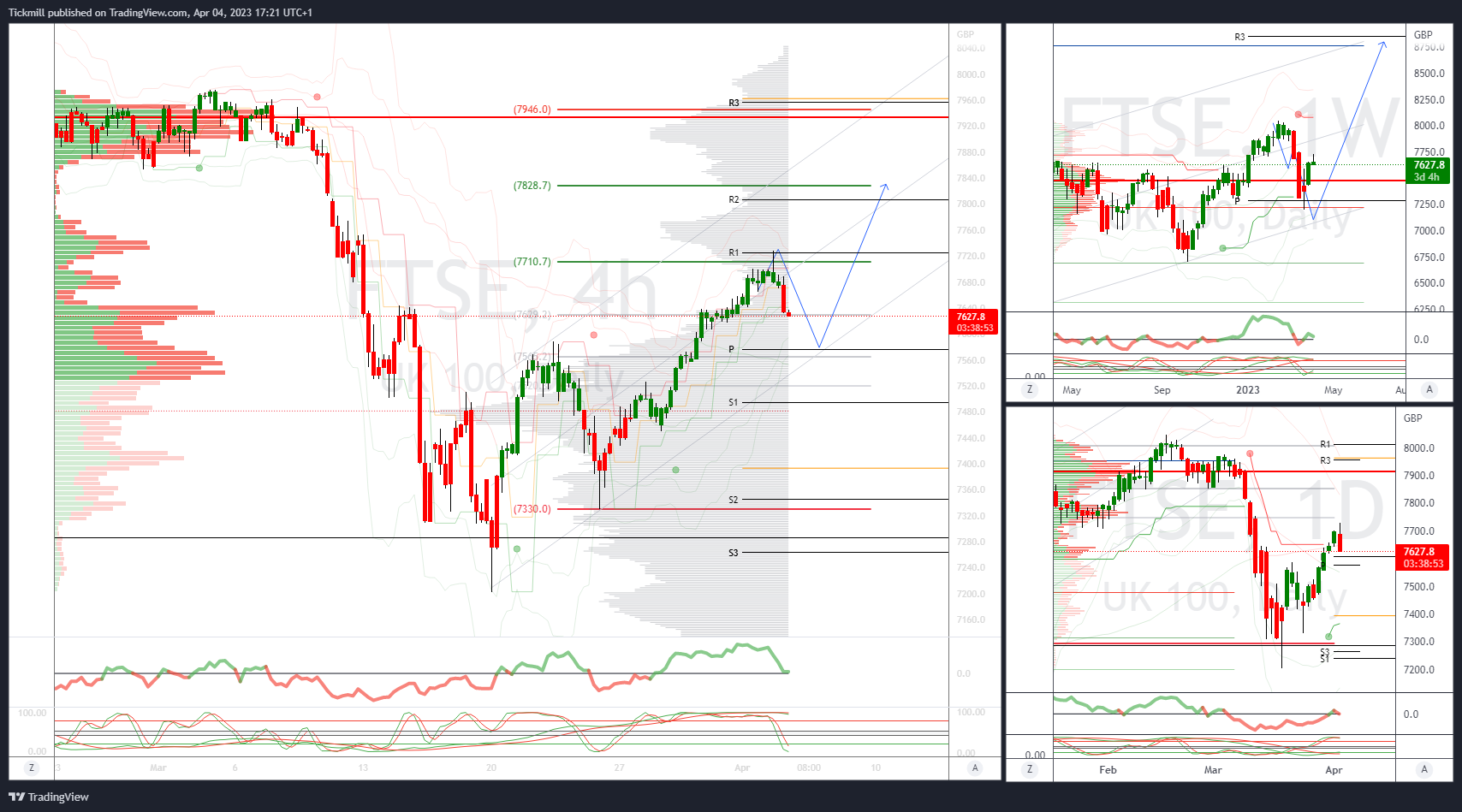

FTSE Bias: Intraday Bullish Above Bearish below 7590

Primary support is 7570

Primary objective 7713

Below 7500 opens 7400

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!