The FTSE Finish Line: March 24 - 2025

The FTSE Finish Line: March 24 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

On Monday, the FTSE 100 index in the UK experienced a choppy start to the week, fluctuating between small gains and losses. Initially, the blue-chip index was supported by the robust performance of mining shares, while investors looked for greater insight into U.S. President Donald Trump's plans for tariffs. This week is poised to deliver significant economic updates, including UK inflation data, a mid-year budget review, and the U.S. Federal Reserve's preferred inflation gauge. However, market sentiment is likely to be shaped by developments surrounding U.S. President Donald Trump's global reciprocal tariff plans, set to take effect on April 2. On the domestic front, Britain's vast services sector has shown signs of growth, according to a recent survey, offering some reassurance to Finance Minister Rachel Reeves ahead of a challenging speech on the economy and public finances this week. The preliminary UK S&P Purchasing Managers' Index (PMI) for the services sector climbed to a seven-month high of 53.2 in March, up from 51 in February.

Single Stock Stories & Broker Updates:

Shares of Tesco, Marks and Spencer, and Sainsbury's fell by 1%, 1.2%, and 1.6%, respectively, making them top losers on the FTSE 100 index. Morrisons announced that around 365 employees could lose their jobs due to a store operations reduction to manage significant cost increases. Supermarket chains face potential profit impacts from an expected price war coinciding with upcoming payroll increases. Sainsbury's plans to cut over 3,000 jobs, while Tesco will reduce approximately 400 positions.

Shares of Serinus Energy surge 27% as the firm agrees to be acquired by New York's Xtellus Capital Partners for about £5 million ($6.5 million). The 3.40p-per-share cash offer is a 30.8% premium over Friday's close, with stock up ~48% including session gains.

Shares of Wood Group increased by 13.2% to 43p as the firm extended the deadline for Sidara's takeover offer to April 17. Analysts give a "hold" rating with a median price target of 60p, despite WG having fallen about 42% this year.

Shares of Capita up 5.1% after RBC upgrades to "outperform" and raises PT to 20p from 17p, citing favorable risk-reward and nearing FCF positivity. RBC also expects higher profits from pensions solutions. Three of five brokerages rate it "buy" or higher; median PT is 22.5p. Stock down 2.14% year-to-date.

Plus500 shares rise 1.5% as the company plans to acquire Indian firm MehtaEquities for $20 million, funded by existing cash. Panmure Liberum maintains a 'Buy' rating, targeting 3,095p. PLUSP is up 3% this year.

Shares in UK miners rose 3.4% after J.P.Morgan upgraded the sector to 'overweight'. Anglo American led with a 4.36% increase to 2,353.5 pence, while other miners like Antofagasta and Glencore gained over 2%. The brokerage anticipates a 'V-shaped' recovery in metal prices and mining equities in late Q1 due to China's economic support. JPM Commodities Research predicts a 15% increase in copper prices to $11,500/ton by Q2 2026. The year-to-date sub-index is down approximately 5.29%.

Technical & Trade View

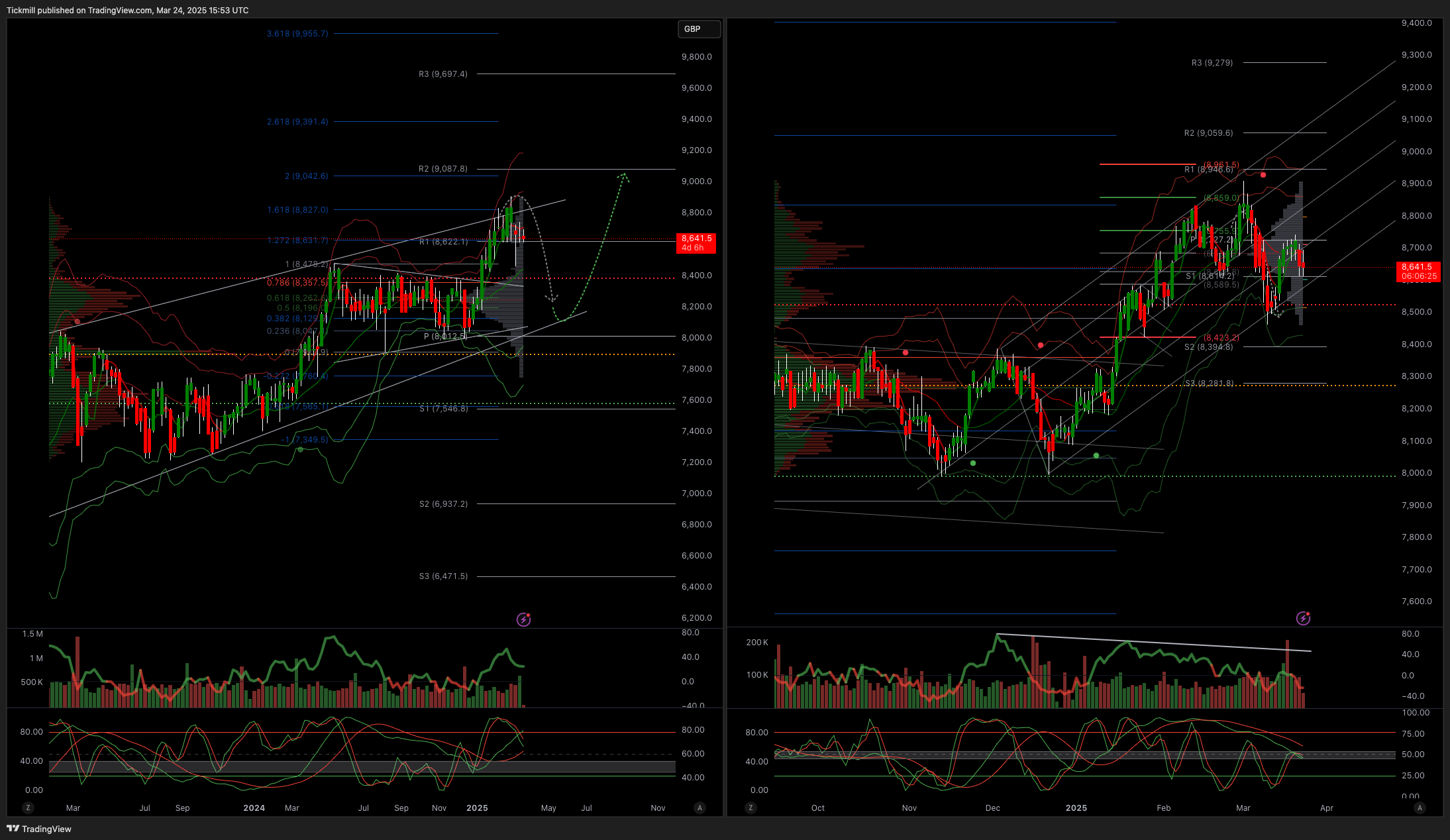

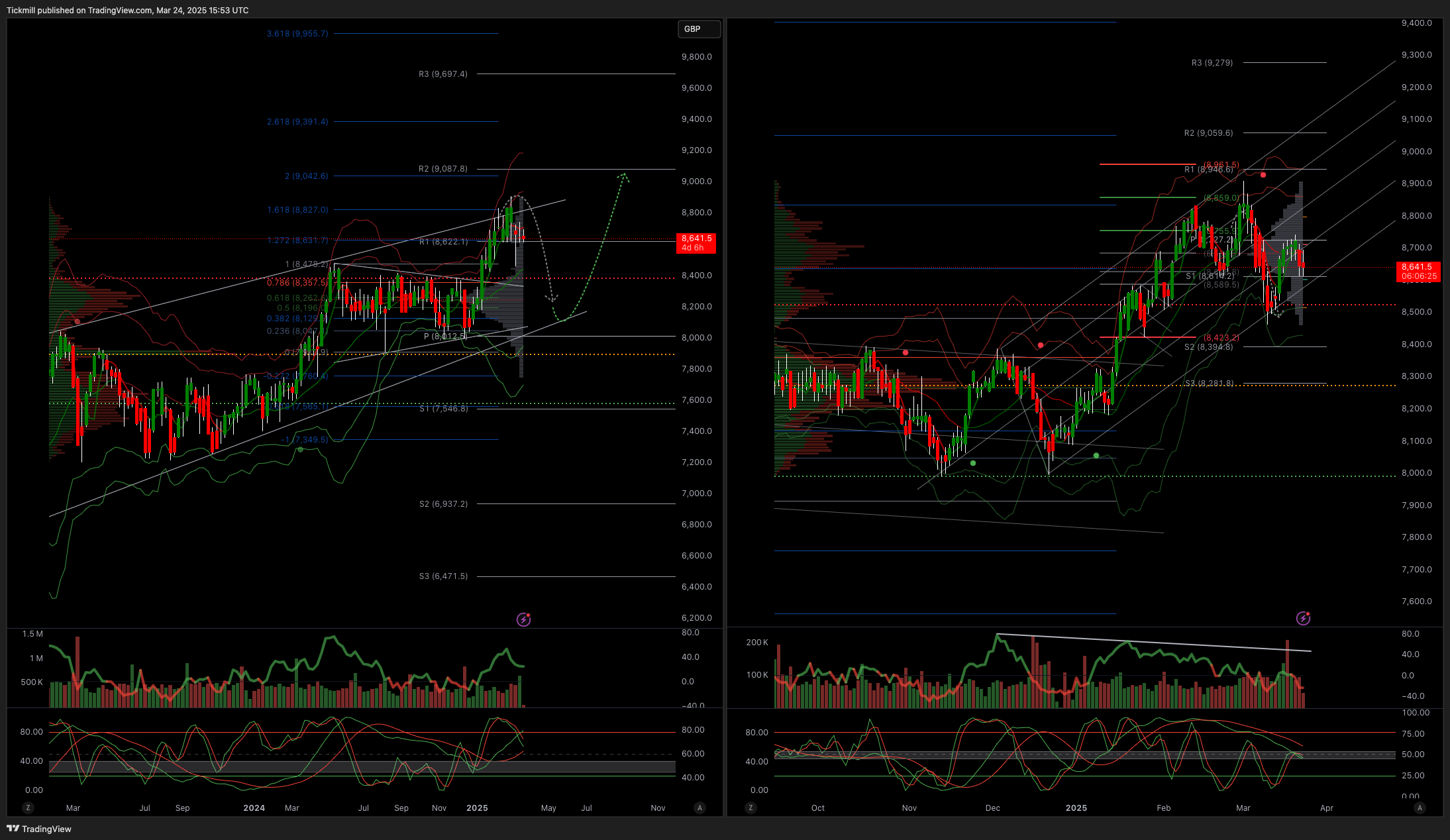

FTSE Bias: Bullish Above Bearish below 8950

Primary support 8700

Below 8700 opens 8600

Primary objective 9050

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!