SP500 LDN TRADING UPDATE 7/11/25

SP500 LDN TRADING UPDATE 7/11/25

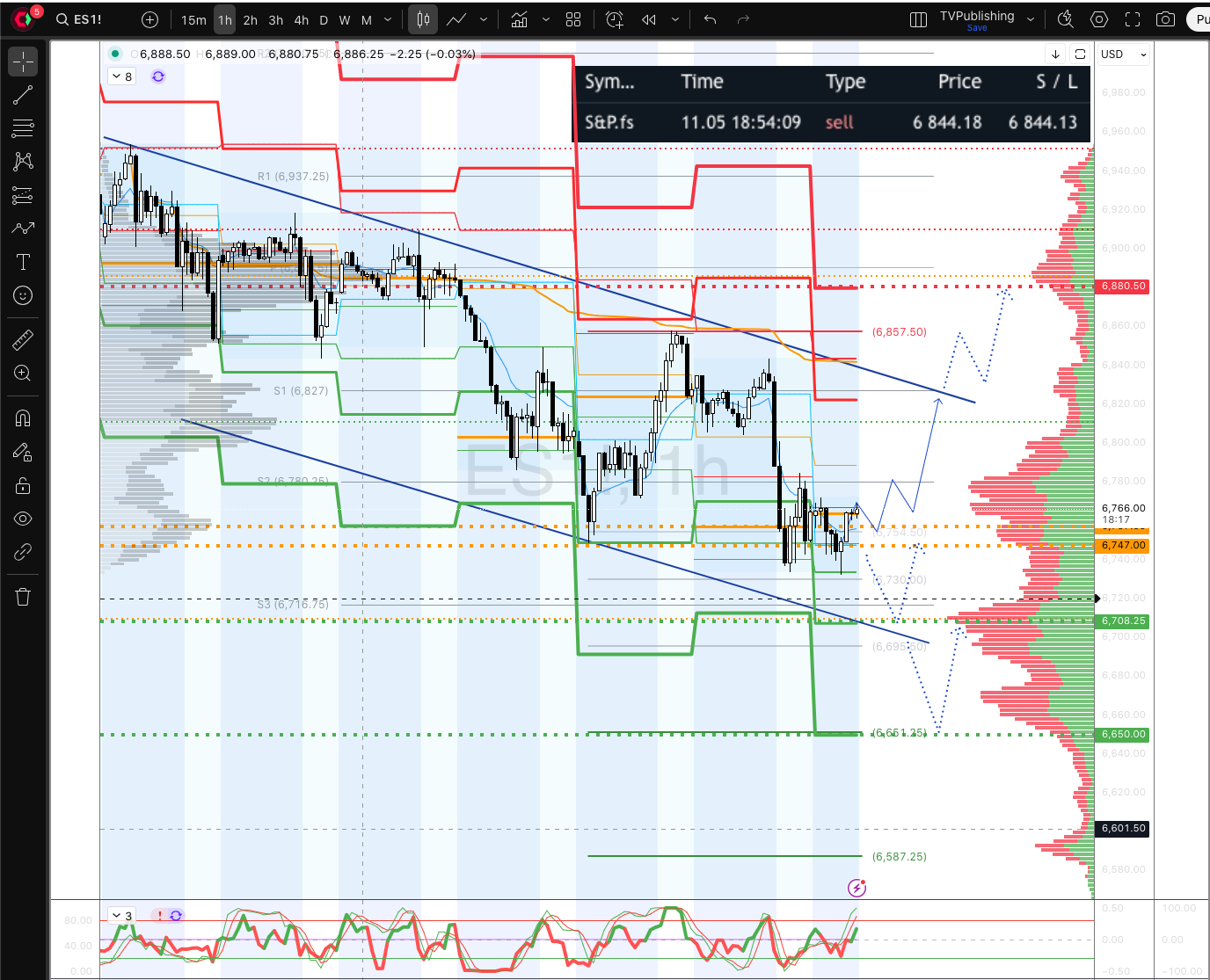

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6820/10

WEEKLY RANGE RES 6981/6767

NOV EOM STRADDLE 6929/6399

NOV MOPEX STRADDLE 6929/6399

DEC QOPEX STRADDLE 6626/7054

DAILY STRUCTURE – BALANCE - 6857/6789

DAILY BULL BEAR ZONE 6747/57

DAILY RANGE RES 6823 SUP 6706

2 SIGMA RES 6885 SUP 6645

DAILY VWAP BEARISH 6807

VIX BULL BEAR ZONE 18.5

TRADES & TARGETS

LONG ON ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: SKEPTICISM

S&P closed down 112bps at 6,720 with a Market-on-Close (MOC) imbalance of +$150M to buy. NDX dropped 191bps to 25,130, R2K declined 164bps to 2,424, and the Dow fell 84bps to 46,913. Trading volume reached 20.7 billion shares across all U.S. equity exchanges, surpassing the year-to-date daily average of 17.4 billion shares. The VIX rose 866bps to 19.57. WTI Crude slipped 10bps to $59.54, the U.S. 10-Year Treasury yield fell 7bps to 4.08%, gold edged down 8bps to $3,989, the DXY dropped 50bps to 99.70, and Bitcoin declined 2.9% to $100,609.

The NDX experienced its third pullback of more than 100bps in the last six sessions, now sitting approximately 4.2% below all-time highs. This has sparked discussions about the causes—negative earnings asymmetry, job market concerns, fatigue, AI skepticism, or other factors—and the potential duration and follow-through, as the NDX hasn't seen a 5%+ pullback in six months. Notably, AI skepticism has increased, fueled by recent debates regarding a potential "federal bailout" for AI infrastructure. Former Trump AI official stated on X: THERE WILL BE NO FEDERAL BAILOUT FOR AI, responding to OpenAI CFO Sarah Friar’s mention of a possible federal backstop for AI financing (WSJ).

Sentiment was further dampened by HAMMACK: DON'T SEE ELEVATED INFLATION AS PURELY TRANSITORY and labor market headlines. Revelio data reported the U.S. lost 9,100 jobs in October, following Challenger data showing 150,000 job cuts in October, three times higher than last year and one of the biggest surges in 20 years.

Activity levels on the trading floor were subdued, rated a 5 on a 1-10 scale. The floor ended the session down 69bps for sale, compared to a 30-day average of +19bps. Single-stock flows remained relatively muted despite the market moves. Long-only funds finished as small net sellers, with broad supply across tech and discretionary sectors. Hedge fund flows were flat, with supply in financials, tech, and energy offset by demand in macro.

Earnings movers after hours included ABNB (+3.5%), EXPE (+9%), TXRH (-3%), TTWO (-11%), and DKNG (-6%).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!